Is the Mobile Payment Tipping-point Approaching in the US?

If recent surveys regarding mobile wallet use are accurate, the mobile payment boom is about to happen. The next two years could see a rapid adoption of mobile wallets among credit card holders, causing a paradigm shift in the way we make purchases offline and online.

20% of US Customers Are “Likely” to Load Their Credit Card into a Mobile Wallet

According to Business Insider’s Intelligence Unit the potential number of adopters of mobile wallets in the United States, among consumers with credit cards, is growing fast. The survey measured credit card holders’ negative and positive intent to store their credit card information into a mobile wallet as “Not Likely” or “Neutral,” and “Likely” or “Definitely” respectively. They also measured the number of people who “Already Have” stored credit card information into a mobile wallet.

If this data holds true, it’s likely we are on the precipice (FINALLY!) for a mobile payments boom in the United States.

Scenarios for a Mobile Payment Boom

Scenario One: Entrenched Laggards, Constant Growth of Positive Intent

My first impression from this chart by BI Intelligence was that there is a wave of mobile payment adoption coming among credit card holders. However, we need to make some assumptions to see how rapidly this wave is approaching. First, let’s try to get a grasp on the situation.

Key Assumptions:

- 33% of respondents who say they are “definitely” going to load their credit card DO

- 33% of respondents who say they are “likely” to load their credit card DO

- People with negative intent (“Not Likely” or “Neutral”) will remain fixed

- YoY Growth for positive intent will remain constant

In this What-if scenario, we can clearly see that the number of people planning to store credit card information in 2017 will likely increase at a faster rate than previous years. At a constant rate of YoY growth in positive intent only 95% of the population is represented. It is also likely the laggards will continue to decrease over time though we have kept them constant in this scenario.

Furthermore, if we reduce the number of people with positive intent who actually load their credit card -- conversion -- from one in three (33%), the growth rate for people who are “Likely” or “Definitely” going to use a mobile wallet must increase even more dramatically.

Scenario Two: Laggard Floor, Moderate Conversion

Let’s modify our key assumptions to create a scenario where we have a moderate conversion from intent to action and growth in positive intent, but a similar distribution of responses over time.

However, let’s also assume there is a floor for laggards who show negative intent.

Key Assumptions:

- 33% of respondents who say they are “definitely” going to load their credit card DO

- 20% of respondents who say they are “likely” to load their credit card DO

- The sum of negative intent (“Not Likely” or “Neutral”) cannot be less than 16%

In this scenario we get a picture that’s more believable. We see a spike in positive intent next year, and have adjusted the growth of positive intent moving forward so we get a similar distribution among “Likely” and “Definitely” reponses. At the same time, assuming a moderate conversion rate (one in five, and one in three respondents respectively) among people with positive intent, we see a nice growth curve among those who “Already Have” stored their credit card information into a mobile wallet.

Among those consumers who have already stored their credit card into a mobile wallet, how many do we think have transacted? In general we see a drop in retention of 33% for any major step along an experience. That leaves us at 66% of people who stored a credit card on a mobile wallet, transact with a mobile wallet; which is about what we would expect based on media reports on Apple, Android, and Samsung Pay use among consumers who can use the service.

Does this seem like an aggressive forecast? Not really. If this is correct, it puts consumers transacting with a credit card via a mobile wallet around 30% in 2019.

In other words, half way through the Early Majority stage on the Diffusion of Innovation scale.

Does this mean my Mobile Wallet is about to be really successful?

It’s unclear what success means, but certainly it means a paradigm shift in the way people transact in less than five years. There are many companies banking on this shift, hence the options for consumers are growing as the market is becoming more fragmented.

Currently, most players measure success by number of registered cards, number of transactions, and the value of those transactions. However, profitability for mobile wallets is something still in the future, though certainly that future is less distant today.

How long can you stick in the fight?

Many traditional financial institutions will continue to see their mobile wallet as a value-added service, while customers who are over-served by those institutions will adopt alternatives with superb mobile experiences. Eventually, those alternatives are likely to move up-market taking away more of the retail banking market from traditional financial institutions.

Are you focusing on a superb mobile experience?

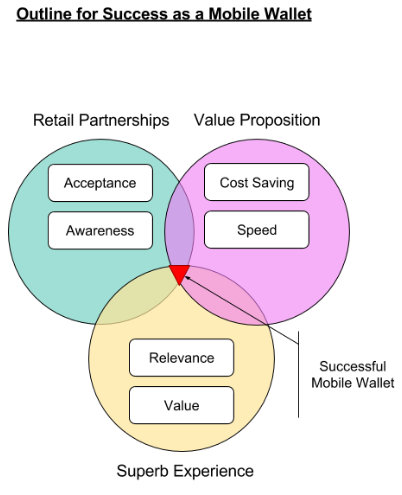

Of course, your payment service is worthless without acceptance. It is essential to have great retail partners who are part of the daily lives of your target audience. And while acceptance is key, so is awareness of your mobile wallet.

Most iPhone 7 users who have a credit card stored on Apple Pay fail to use it because they simply forget it is an option or they don’t know it is. Of course, universal acceptance would resolve this… but until you can get that (please don’t hold your breath) making sure your customers know where your mobile wallet is accepted is critical.

Combining these two critical factors, Acceptance and Awareness, into a superb mobile experience will mean you have a shot at catching onto and riding that wave of mobile wallet adoption.

Can you monetize enough?

The question still remains, how can you monetize your mobile wallet even with a wave of new customers? The recipe for success in consumer-facing mobile payments is still unclear.

There is a plethora of business models and new technologies being experimented with all the time by dozens of players across the payments value chain. Many of these are designed to reduce cost and generate income from that savings, others are designed to create more value by offering discounts or loyalty rewards, while others promise a faster checkout, or try to provide instant settlement.

The list of players is long and diverse. In nearly every country in the world there are several mobile payments players including banks, startups, telcos, retailers, and OEMS. There is a different recipe for each of them.

Ultimately the winners in each market will be those services which can combine Acceptance and Awareness, with a Superb Experience, and a unique Business Model which leverages New Technologies that address cost and speed. I wouldn’t call that a recipe, but perhaps you can call it an outline.