Is the Mobile Payment Tipping-point Approaching in the US?

- 33% of respondents who say they are “definitely” going to load their credit card DO

- 33% of respondents who say they are “likely” to load their credit card DO

- People with negative intent (“Not Likely” or “Neutral”) will remain fixed

- YoY Growth for positive intent will remain constant

- 33% of respondents who say they are “definitely” going to load their credit card DO

- 20% of respondents who say they are “likely” to load their credit card DO

- The sum of negative intent (“Not Likely” or “Neutral”) cannot be less than 16%

Bluetooth Mesh Networks for Retail

| Bluetooth Smart Mesh Network |

| Experiences Adapt To You From Room To Room |

| Signage Alerts When You Arrive |

| Dynamic Prices On Electronic Labels |

| Flooding Subsets To Adapt For Audience Profiles (Green vs Orange) |

Are Self-Published Authors Earning $1 Billion on Amazon?

The Martian was a self-published serial novel that just got traction. Its popularity online caught the attention of Crown Publishing (a division of Penguin Random House) and the rest is history. Success stories like The Martian will certainly inspire more writers to self-publish directly to their audience rather than submit to the complex and onerous demands of the publishing industry.

Amazon's future could be acquisition...

Well, it's a gloomy Monday but don't let the weather keep you down. It just means some makeoli and Korean seafood pancakes are waiting for you somewhere. ;-)

Last week most of us witnessed Amazon's unveiling of the new Prime Delivery drones. Bezos says the service will be running in 4-5 years, despite the challenges and many skeptic reviewers it is entirely possible that will happen. The doubters claim three major issues: vandalism, safety, and theft.

The real BIG THREE challenges have nothing to do with these challenges (which anyone with a mild imagination can figure out how to solve). Rolling out a drone delivery network takes... well, first a (1) NETWORK! Creating any kind of network, software or hardware, is not small task and requires lot's of really smart and creative folks from all levels of abstraction to get down. The next REALLY BIG challenge is the (2) OS. What will run these systems? Android? Not likely. Which leads me to the FINAL BIG challenge, the (3) battery. Even if you manage to get the right network, and the right OS... you still need a battery -- of course, if you read my email about Graphene you might not consider this to great a challenge!

Enter... the entrepreneur.

Matternet is an awesome startup that will be either the next big platform or, at the very least, a significant acquisition down the road. Backed by Andreesen Horowitz (two guys who have a knack for early-stage investing I'd say) the company is rolling out it's network where the walled gardens have the North can happily get involved... Africa. How do you convince an unwilling populace to adopt the technology? Make it about helping people (since it is ultimately anyway!). How do you get your medicine in 30min instead of 5 days? Drones.

The company was founded way back in 2011, and has since developed it's first drone which can carry a small package. Their ultimate goal is to deploy delivery drones which can carry up to 1000kg.

Enjoy... and BTW if you're from Seoul watch the video for a neat surprise.

https://mttr.net

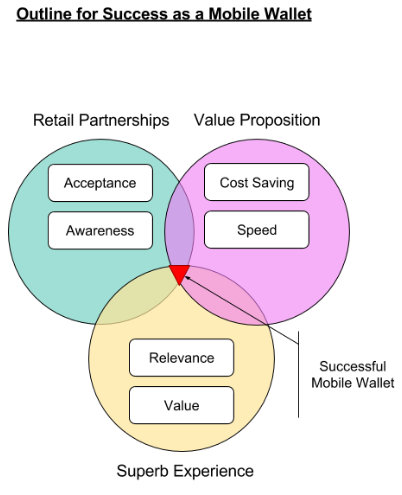

The App & Mortar Opportunity

What is “App & Mortar”?

By 2010 every destination shopping center was crowded with a new way to drive traffic to their stores, but no-one has been able to do it right. Yet.

At the time, several applications sprung up that tried to address the market including Shopnear.me, Snapette, Shopkick, Fancy, and more. The runaway success of Groupon and LivingSocial (starting a little earlier in 2008) left some important lessons for new ventures in the space. Specifically, retailers were frustrated with cash-flow problems created by newbies who came once and never again, not to mention the potential for erosion of loyalty and brand value.

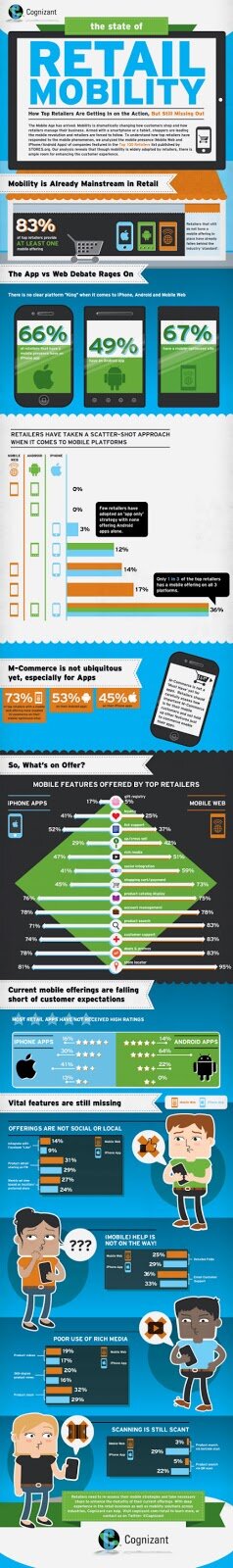

In 2012 and '13 big retailers are finally taking this opportunity into their own hands. According to Flurry, the “App & Mortar” segment of mobile applications grew by more than 500% in the past year. Flurry’s data indicates much of this growth was driven by the likes of Starbucks, Walmart, and Macy’s, who have all invested significant resources into their own mobile strategy.

Forbes reported that more than 80% of retailers have a presence on mobile (Check out the infographic below by Cognizant). Most of them are offering all the things you’d expect, from shopping and payment to (of course) deals and store location. Retailers who can, do have a mobile presence, and some are doing a great job of executing.

What’s the big opportunity?

Shopping is often about brands, but those brands extend to the destinations. In 2010, my briefly lived startup focused on Santana Row, San Jose, precisely because the location itself is a brand. People travel there to shop, but also to spend an afternoon with family and friends. It’s a social experience as much as anything. These destination cater to a consumer who enjoys spending an afternoon in a well decorated space, where beautiful and unique things surround them, and (of course) can be acquired.

There are hundreds of high-quality individual or regional shops in any given, well-branded, retail destination. This includes a range of retailers from clothing and accessories, to health and beauty services. Are we going to rely on each retailer to have his or her own application? Do the math, that’s a lot applications and no-one wants to spend the energy to keep track of them all.

Big retailers have the advantage, since we all could use a Starbucks app or Westfield Mall app. However, that leaves a huge opportunity for the App & Mortar retail aggregators servicing the destinations and the experience. Connecting people with brick-and-mortar retail through mobile devices will change the way we shop; rather, already has. But the real promise of mobile applications for retail has yet to be fully realized.