Is the Mobile Payment Tipping-point Approaching in the US?

If recent surveys regarding mobile wallet use are accurate, the mobile payment boom is about to happen. The next two years could see a rapid adoption of mobile wallets among credit card holders, causing a paradigm shift in the way we make purchases offline and online.

20% of US Customers Are “Likely” to Load Their Credit Card into a Mobile Wallet

According to Business Insider’s Intelligence Unit the potential number of adopters of mobile wallets in the United States, among consumers with credit cards, is growing fast. The survey measured credit card holders’ negative and positive intent to store their credit card information into a mobile wallet as “Not Likely” or “Neutral,” and “Likely” or “Definitely” respectively. They also measured the number of people who “Already Have” stored credit card information into a mobile wallet.

If this data holds true, it’s likely we are on the precipice (FINALLY!) for a mobile payments boom in the United States.

Scenarios for a Mobile Payment Boom

Scenario One: Entrenched Laggards, Constant Growth of Positive Intent

My first impression from this chart by BI Intelligence was that there is a wave of mobile payment adoption coming among credit card holders. However, we need to make some assumptions to see how rapidly this wave is approaching. First, let’s try to get a grasp on the situation.

Key Assumptions:

- 33% of respondents who say they are “definitely” going to load their credit card DO

- 33% of respondents who say they are “likely” to load their credit card DO

- People with negative intent (“Not Likely” or “Neutral”) will remain fixed

- YoY Growth for positive intent will remain constant

In this What-if scenario, we can clearly see that the number of people planning to store credit card information in 2017 will likely increase at a faster rate than previous years. At a constant rate of YoY growth in positive intent only 95% of the population is represented. It is also likely the laggards will continue to decrease over time though we have kept them constant in this scenario.

Furthermore, if we reduce the number of people with positive intent who actually load their credit card -- conversion -- from one in three (33%), the growth rate for people who are “Likely” or “Definitely” going to use a mobile wallet must increase even more dramatically.

Scenario Two: Laggard Floor, Moderate Conversion

Let’s modify our key assumptions to create a scenario where we have a moderate conversion from intent to action and growth in positive intent, but a similar distribution of responses over time.

However, let’s also assume there is a floor for laggards who show negative intent.

Key Assumptions:

- 33% of respondents who say they are “definitely” going to load their credit card DO

- 20% of respondents who say they are “likely” to load their credit card DO

- The sum of negative intent (“Not Likely” or “Neutral”) cannot be less than 16%

In this scenario we get a picture that’s more believable. We see a spike in positive intent next year, and have adjusted the growth of positive intent moving forward so we get a similar distribution among “Likely” and “Definitely” reponses. At the same time, assuming a moderate conversion rate (one in five, and one in three respondents respectively) among people with positive intent, we see a nice growth curve among those who “Already Have” stored their credit card information into a mobile wallet.

Among those consumers who have already stored their credit card into a mobile wallet, how many do we think have transacted? In general we see a drop in retention of 33% for any major step along an experience. That leaves us at 66% of people who stored a credit card on a mobile wallet, transact with a mobile wallet; which is about what we would expect based on media reports on Apple, Android, and Samsung Pay use among consumers who can use the service.

Does this seem like an aggressive forecast? Not really. If this is correct, it puts consumers transacting with a credit card via a mobile wallet around 30% in 2019.

In other words, half way through the Early Majority stage on the Diffusion of Innovation scale.

Does this mean my Mobile Wallet is about to be really successful?

It’s unclear what success means, but certainly it means a paradigm shift in the way people transact in less than five years. There are many companies banking on this shift, hence the options for consumers are growing as the market is becoming more fragmented.

Currently, most players measure success by number of registered cards, number of transactions, and the value of those transactions. However, profitability for mobile wallets is something still in the future, though certainly that future is less distant today.

How long can you stick in the fight?

Many traditional financial institutions will continue to see their mobile wallet as a value-added service, while customers who are over-served by those institutions will adopt alternatives with superb mobile experiences. Eventually, those alternatives are likely to move up-market taking away more of the retail banking market from traditional financial institutions.

Are you focusing on a superb mobile experience?

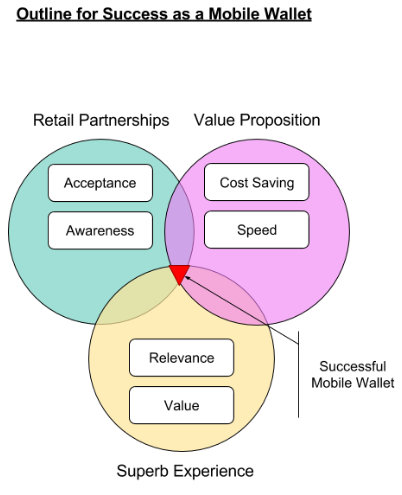

Of course, your payment service is worthless without acceptance. It is essential to have great retail partners who are part of the daily lives of your target audience. And while acceptance is key, so is awareness of your mobile wallet.

Most iPhone 7 users who have a credit card stored on Apple Pay fail to use it because they simply forget it is an option or they don’t know it is. Of course, universal acceptance would resolve this… but until you can get that (please don’t hold your breath) making sure your customers know where your mobile wallet is accepted is critical.

Combining these two critical factors, Acceptance and Awareness, into a superb mobile experience will mean you have a shot at catching onto and riding that wave of mobile wallet adoption.

Can you monetize enough?

The question still remains, how can you monetize your mobile wallet even with a wave of new customers? The recipe for success in consumer-facing mobile payments is still unclear.

There is a plethora of business models and new technologies being experimented with all the time by dozens of players across the payments value chain. Many of these are designed to reduce cost and generate income from that savings, others are designed to create more value by offering discounts or loyalty rewards, while others promise a faster checkout, or try to provide instant settlement.

The list of players is long and diverse. In nearly every country in the world there are several mobile payments players including banks, startups, telcos, retailers, and OEMS. There is a different recipe for each of them.

Ultimately the winners in each market will be those services which can combine Acceptance and Awareness, with a Superb Experience, and a unique Business Model which leverages New Technologies that address cost and speed. I wouldn’t call that a recipe, but perhaps you can call it an outline.

Is RCS Really A Sleeping Giant

Republished from my LinkedIn profile

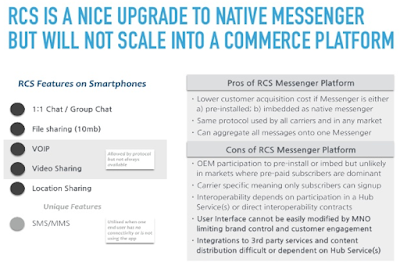

RCS promises to be a major upgrade to the Native Messenger on your Android smartphone. But is all the talk about a Sleeping Giant over blown?

RCS vs. OTT Messengers

RCS, or Rich Communications Services, is a protocol that's been around for several years. It allows carriers to provide services like Voice and Video Calls, File Sharing (think Photos), and of course Chatting 1:1 or as a Group. The problem with RCS for years was that it requires Interoperability between carriers, otherwise end users can only use the messenger among friends on the same network. These contracts take time and create a complicated user experience (Johnny: "Why didn't you get my text?").

Jibe Mobile created a Hub to allow carriers to create one NNI (Network-to-Network-Interface) with their communications service in order to create interoperability with any other carrier also connected to the Hub, provide they used their white-label messenger (Messenger Plus). They offered colourful skins so carriers could "customise" the user interface. Google acquired Jibe last year, and at MWC a few weeks ago they made some announcements. Yippie!

Google's new platform is great, don't get me wrong. However, it is great as an upgrade to the native messenger available on your Android smartphone if it supports RCS (btw only a fraction of all Android devices currently support it, though that will certainly change). The idea that RCS will emerge as a rival to OTT Messengers like WhatsApp, Facebook Messenger, or WeChat (not to mention Instagram, SnapChat, or anything else new that "tweens" are using) is unfounded in reality, or really optimistic.

The bottom-line is people use OTT Messengers (like other social media) because their friends use it, it's personal, it's unique, and often it's private -- or at least more private than your Google-provided messenger. And more than ever, OTT Messengers are evolving to rival not SMS or other Communication tools, but Operating Systems themselves. They are the new layer upon which all m_commerce is being built... or rather integrated with.

If App distribution was broken before, it's dead now. The tops apps are almost always Facebook, Google, or Apple (or some other usual suspect). Services, both private and public, don't have the time or money to compete with those giants for audience. Enter the OTT Messenger with a dedicated audience that's big and local. On-demand services, eCommerce, traditional businesses, public services, payment (p2p, c2b, and even c2g) can all be integrated to the OTT Messenger. And these integrations can be surfaced, or not, based on wherever the user is. WeChat is a great example of this, and they are pushing into Subsaharan Africa something fierce with their major shareholder Naspers. That's significant in several ways, but in terms of the above examples that means millions of people who are already using their phones to pay for everything. A nudge may be all it takes to put WeChat and Naspers at the centre of m_Commerce there similarly to how WeChat has positioned itself in China.

In addition to services, OTT Messengers are ideal for content distribution which drive downloads for other types of apps. This could be anything, literally.

So sleeping giant? Maybe, those guys at Google are obviously creative and smart. We'll see what they come up with. But on the face of things, Google's new Jibe makes for some fancier Native Messengers, but will hardly impact the impressive rise of OTT Messengers to the centre of our smartphone experience.

Checkout some clips from my slideshare below or see the whole thing:

http://www.slideshare.net/malesniak1/rcs-vs-ott-messengers

http://www.slideshare.net/malesniak1/rcs-vs-ott-messengers

2015 NRF Big Show Recap

The National Retail Federation’s 104th Annual Big Show was amazing. More than 35,000 executives and the like attended the world’s largest expo for retail. It was my first show, and it was truly awesome. I came back with several new perspectives and insights, as well as reaffirmed confidence in the trajectory of omnichannel retailing. For me, this has been an area of interest for several years so it is exciting to final attend in the Big Show, and see how quickly we are approaching the vision for the Future of Retail -- something many of us have been working for since 2009 or even earlier.

My high level takeaway is that omnichannel retailing is the evolving standard for retail. Retailers will implement a variety of tactics to further implement Omnichannel into their business and marketing operations, with In-Store Experiences central to most aspects of their Omnichannel strategy.

Omnichannel

Omnichannel is an evolving new standard for retail which prioritizes the customer, which requires business practices to adapt to a complex customer journey and marketing practices to adapt to a new “segment of one.”

Fulfillment: Omnichannel fulfillment is a major issue for retailers. This requires Real-Time Inventory accessible from all stores, in-other-words centralized; Distributed Order Management, or the ability to accept and fulfill orders (and update inventory in real-time) from across channels: online, mobile, in-store. This enables drop-shipping from local stores to reduce fulfillment time (online orders); recommendations for local stores where desired inventory is in-stock and can be purchased for pick-up (mobile); have an item shipped from the store, or have an item in a different size, color, etc shipped from a different store for pick-up at a local store or directly to the customer (in-store). Some good examples of omnichannel fulfillment included Netsuite’s “Customer Commerce”

RFID: Omnichannel fulfillment can be implemented without RFID, but achieve the full promise of Intelligent Fulfillment technology such as RFID will be necessary. Real-Time logistics and inventory data, as well as in-store tracking of products and even people (e.g. Intel presented an in-store tracking solution which integrated RFID into a shopping bag), as well as unique customer experiences which simply product discovery and savings.

Segment of One: Aggregating Individual Data combined with Granular Data in Stores, Distribution Centers, and up the Supply Chain will allow for segmentation on an individual basis. This will fulfill the promise of personalization where predictive models based on averages have failed. Technology innovations for real-time inventory and in-store tracking will help, but gaining customers to provide individual data requires stores to innovate around consumer experiences to create value. IBM’s description of Segments of One is comprehensive (if generic), but this goes beyond a profile. Stores and consumer software should provide relevant experiences by determining the context of the store visit: Is she in a rush? Is the dwelling? Is she lost or not sure what to buy?

Actionable Data: Collecting and aggregating data from inventory, in-store tracking, etc., provides information; individual data allows us to determine context which makes data actionable. To gain individual data consumers must perceive value proportional to the risk of providing the information. Value can be created via Savings, Efficiency, and Engagement. Some examples: 78% of customer report they would like to view signs with special promotions (savings), and 67% favor in-store guidance through digital signage (efficiency).

Integrated Data: Breaking down silos is critical to realizing a truly omnichannel store, and the burden rests heavy on software providers. Data must become unified from customer-end to supplier-end and made available to the retailer for real-time analytics. A variety of middleware options to help software vendors integrate data are emerging: e.g. Mad Mobile, Highjump.

Retail Devices

Retailers will purchase a variety of devices that align to their omnicommerce strategy.

Kiosks: A low-hanging fruit for retailers, new kiosks will be installed in 2015 for a variety of use-cases including: bill payment, interactive-tabletop, assisted selling, reporting and personnel management. Both Microsoft and Samsung demonstrated new kiosks, and made partnership announcements: Hardee’s and TGI Fridays will deploy self-order kiosks (Microsoft); Freshwater and ComQi will partner with Samsung to power assisted shopping.

Digital Signage: Arguably the second priority for retailers -- after actionable data -- retailers will quickly adopt digital signage as a low-hanging fruit to implement new in-store experiences as part of their omnichannel strategy. Two of the most impressive exhibits at NRF ‘15 were eBay’s Magic Mirror and Memomi by Memory Mirror (Palo Alto-based startup). Integrating digital signage with real-time data analytics, inventory and fulfillment, and presence technology will be an important part of most retailers omnichannel strategy, if not aspirational since truly integrated and actionable data is still a goal, not a reality, for most (all) retailers. Scala, Lexmark, Toshiba, Samsung, also had noteworthy digital signage exhibits. Lexmark is expected to rollout at Bestbuy, Office Depot, Safeway and 70+ more retailers.

Electronic Shelf Labels: A variant of digital signage, ESL could be a quietly emerging trend. There were two varieties of ESL, one which uses LCD strips to display a variety of content and another which uses e-ink to dynamically display essential information typical to existing labels. The displays can be invoked by presence technology, facilitating dynamic pricing (for example) based on digital coupons stored on a mobile app.

Printer Integration: There were two solutions that addressed our printer integration problem. Ecrebo, a UK based company, which provides an SDK to interface with any printer. The other, Counect, was featured at Intel’s booth and solved the same problem using hardware called Counect Cube. This device operates as a Smart Gateway which utilizes any form of connectivity be-it Ethernet/Wi-Fi/3G/Bluetooth4.0 to interface with the printer and capture transaction data along with customer data.

mPOS: There were a host of mPOS devices from traditional POS players, though Vend and First Data’s Clover were also on site. Retailers will procure devices capable of a variety of payment methods in addition to EMV and Contactless Card. Microsoft Windows 8 POS on notebooks, desktops, tablets and phones were common as well as pairing with iPhone and Macbooks. 1D Laser Scanners, CCD Scanner, 1D/2D Image Scanners, NFC. Zebra Technologies exhibited a variety of Motorola mPOS (acquired), and Korean makers POS BANK and Bluebird had a strong presence.

In-Store Analytics

There is a wealth of information being acquired, and retailers are quickly implementing more strategies to gain better insights across multiple channels and locations. Understanding what is happening in-store is helping retailers improve marketing, assortments (merchandise), staffing, and fulfillment.

WiFi, Beacons, Cameras: Numerous companies exhibited In-Store Analytics solutions which leveraged WiFi, Bluetooth, or Cameras; the majority of them deploying devices integrating one or all of these. People Counting (check-in), Window Display Effectiveness, Customer Journey Tracking, etc. These solutions are packaged as engagement and staff management solutions, but typically were not integrated with inventory, personnel management, or CRM. Some standout companies were Nomi, Airwatch (VMWare), Euclid and RetailNext; however, there is a clear opportunity to provide truly end-to-end solutions. It is also important to note that several data science and analytics companies are forming close partnerships with device (wifi, beacon, camera) manufactures indicated consolidation is possible if not likely.

Retail Growth Strategies

Retailers are eager to grow amidst a global recovery, low cost of transportation of goods (aka cheap oil), and newly emerging markets (Southeast Asia, Africa). With intensified competition from both incumbent online retailers as well as brick-and-mortar retailers they are employing strategies to gain market share and differentiate themselves in ways that go beyond technology.

Diversification: Major retail brands are diversifying their brand with new products and services. For example, Birchbox launched a brick-and-mortar store where customers can take home product samples in addition to purchasing. Ralph Lauren opened a new flagship featuring Ralph’s Cafe, and Lululemon launched men’s line with an in-store grooming parlor.

Going Big: Several retailers presented on strategies for going global. The consistent was to do it, and do it big when you do. Launching 200 new locations as part of a regional expansion strategy was preferred to (for example) 10 new stores in the UK alone.

Storytelling: An extension of in-store experience, retailers will strive to differentiate amongst themselves and -- importantly -- against online retailers by providing a story to customers. The objective is to transform brick-and-mortar into a destination.

Examples of Future Stores

There were a few outstanding examples of technology implementations. Among them, standouts were Rebecca Minkoff, Intel, IBM-Apple, and Microsoft.

Rebecca Minkoff: Hands-down the most complete demonstration of “The Future of Retail” the store implemented useful technology to enhance the In-store shopping experience.

IBM-Apple: IBM launched its MobileFirst for iOS retail enterprise apps Sales Assist and Pick & Pack. Each are powered by Watson, and are part of a new suit of enterprise apps which will include apps for banking, retail, insurance, financial services (insurance), telecom, government, and airlines.

“The Sales Assist app lets sales associates check customer profiles and make shopping suggestions based on purchase histories, as well as check in-store inventory, locate items in-store and arrange to ship out-of-stock items to the customer. The Pick & Pack app, meanwhile, combines in-store proximity-based tech (beacons) with back-end inventory insight to improve order fulfillment, and is 70% ready to go out-of-the-box.” - brandchannel

Microsoft End-To-End IoT: Azure HDInsight and Power BI for Office 365 makes it easy for retailers to track revenue, product searches, customer purchasing, social media activity, etc. Can easily access Power Map for Excel to represent responses to online ads, comparing by region or IP. Kinect for Windows is used for in-store tracking of product and customer movement where data is analyzed by Azure Stream Analytics. Azure Machine Learning can make predictions about individual consumers purchasing interests in coming days, weeks, months; and manage inventory in departments, stores, or region. - Microsoft Blog

Conclusion

Though the full vision of an omnichannel store is still aspirational, investments by retailers and vendors are bringing that vision closer to reality than ever before. This new paradigm in retail --a real-time, data driven, customer-focused, destination-creating, renaissance-- is evolving. I guess that means next year I can go back to New York? Hope so!

Looking Forward to 2015: Part Two

While mPOS will drive significant disruption in 2015 for transaction processing, it is also enabling consumers to embrace mobile payments. That's because EMVco has designed EMV to work with NFC for contactless payments. The rise of Host Card Emulation (HCE), a term attributed to the founders of SimplyTapp, is also a driving force since it lowers the barrier for mobile payments by eliminating the need for hardware called a Secure Element (SE).

It’s all very exciting, and the bottom-line: mobile payments will become a force majeure among payment methods within a few years. Business Insider predicts US Mobile In-Store Payment volume will grow 172% for the next 5 years. Data compiled by Statista.com has breaking $700B by 2017.

Mobile Payments Become a Normal Payment Method in 2015

First, I wrote about this last year in a post about digital wallets, when Apple Pay was still a blip on the buzz-radar. Digital Wallets really needed mobile payments to come-of-age, and now they are.

Mobile payments got a huge injection of consumer confidence from the release of Apple Pay. Anyone would assume Apple’s share of global mobile payment transactions will be significant, eventually. But remember, there are several very real competitors. Just a few years ago many predicted that PayPal would “win” the mobile payments market, now Apple Pay is all the rage. The reality is there probably will not be any clear winners, not for a while anyway.

Mobile payments got a huge injection of consumer confidence from the release of Apple Pay. Anyone would assume Apple’s share of global mobile payment transactions will be significant, eventually. But remember, there are several very real competitors. Just a few years ago many predicted that PayPal would “win” the mobile payments market, now Apple Pay is all the rage. The reality is there probably will not be any clear winners, not for a while anyway.

Products like Softcard, MCX, Apple Pay, Google Wallet, and not to mention whatever Amazon is cooking-up, are all vying for transaction volume in 2015, with a tipping-point of relevancy approaching somewhere between now and 2017. Venture Capital, Credit Card Networks (Mastercard and Visa), Banks, OEMs, everyone seems to be making some bets on mobile payments.

Apple Pay

Apple is driving US merchant demand for NFC, period. Other solutions existed for years, but in the US they never drew merchant adoption en masse. That's not the case everywhere, in fact NFC payments are so common in South Korea that literally everyone uses some form of stored-value payment card which is enabled by NFC. However, the unique position of the US means global adoption is now underway.

US merchant adoption was slow until Apple Pay. Business Insider reported that VeriFone, the largest provider of countertop-terminals in the US, has seen a spike in sales of NFC enabled devices since the launch of Apple Pay. That said, Apple Pay is unlikely to become the leader in mobile payments in spite of the important role it plays in growing the market.

And in fact Apple Pay is not garnering the kind of adoption many had hoped for. Some reports show 1% of transaction volume on mobile can be attributed to Apple Pay, not bad I guess but nothing to really brag about. One report also showed that less than 5% of iPhone owners who could enable Apple Pay had done so, and among them on 30% had used it. That said, Wholefoods (one of the most popular merchants for Apple Pay) claims they are witnessing “significant growth” in usage. So there is a ways to go for Apple yet, but integration of BLE and facial recognition software not to mention the Apple Watch will all drive further use of this payment method.

And in fact Apple Pay is not garnering the kind of adoption many had hoped for. Some reports show 1% of transaction volume on mobile can be attributed to Apple Pay, not bad I guess but nothing to really brag about. One report also showed that less than 5% of iPhone owners who could enable Apple Pay had done so, and among them on 30% had used it. That said, Wholefoods (one of the most popular merchants for Apple Pay) claims they are witnessing “significant growth” in usage. So there is a ways to go for Apple yet, but integration of BLE and facial recognition software not to mention the Apple Watch will all drive further use of this payment method.

Google Wallet and Paypal

How do Google and Paypal feel about Apple Pay?

- Happy, because people with Samsung phones will start using mobile payments too!

- Frustrated, because they’ve had NFC mobile payments for years and nobody cared.

- Worried, because this means Apple will sell more phones.

For sure A and B. Not so much C.

Paypal and eBay split just weeks after the launch of Apple Pay. It’s unclear that Apple had anything to do with that, but it is telling. Paypal was once considered the front-runner, now they are just one in a peloton where Apple appears to be slightly ahead.

Paypal and eBay split just weeks after the launch of Apple Pay. It’s unclear that Apple had anything to do with that, but it is telling. Paypal was once considered the front-runner, now they are just one in a peloton where Apple appears to be slightly ahead.

Paypal has an advantage though, it’s really a payments company and builds at least some of the components driving the competition. Braintree, now part of Paypal, supports Apple Pay and enables it for merchants along with Paypal. Paypal has solid legs in mobile payments, announcing partnerships with Samsung, Microsoft, Blackberry (um, the third-leg?), and it works on every platform. Not to mention they own the coolest P2P payment app around, Venmo.

Google has stayed in the peloton on sheer force of will. Sources say they are running a substantial deficit with Google Wallet, desperately trying to get adoption. While Apple generates demand for NFC enabled terminals literally overnight, Google couldn’t pay merchants to enable NFC and accept Google Wallet for years. That's about to change.

Google Wallet represents 4% of mobile payments while Apple Pay is estimated at 1.7% (those numbers will probably increase rapidly in 2015 for both Google and Apple). Google Wallet is also available on iOS and supports TouchID. Google could conceivably ride the Apple Pay wave to attract iPhone users, and there is some indication this has already begun to happen. Since the launch of Apple Pay, Google Wallet usages is up 50% by some accounts. I can see Google using the powerful brand and software ecosystem to subvert Apple Pay even on iPhones, perhaps by managing receipts and bills in Google Drive. Google is already flexing its software muscles with APIs for Objects and Instant Buy.

Softcard

It’s hard to write better fiction than Softcard. The history of this telco-startup reads like historical-realism: US telcos launch mobile payments venture called ISIS, several months later a major terrorist organization called ISIS wreaks havoc on innocent people in Iraq and elsewhere, destroying all hopes of the ISIS mobile payment method becoming a household name.

Well, ISIS is a household name but that’s not exactly what At&t had in mind.

Well, ISIS is a household name but that’s not exactly what At&t had in mind.

Rebranded as Softcard and invigorated by Apple Pay, this digital wallet is signing deals with McDonald’s and Microsoft. While speaking at a conference the CEO of Softcard said he is excited about 2015 since “finally people know what my company does” thanks to Apple Pay. However, the road ahead is going to be filled with challenges for Softcard.

MCX

Apple Pay was the clear buzz winner in 2014, but MCX was a solid second. The Merchant Consumer Exchange (MCX) is a consortium of the largest retailers in the United States -- in some cases the world -- which has committed to launching its own mobile payment method in 2015. The total transaction volume for MCX members was estimated at $1 Trillion last year. MCX made headlines after Apple Pay was launched when some of the member retailers, including CVS, “unplugged” Apple Pay citing an exclusivity clause in their MCX membership agreement.

There were a slew of negative posts by Apple aficionados from well known tech news sites, but many of them exaggerated the situation. The reality is that MCX is in an excellent position because it is retailer owned, which means loyalty rewards can be built in. It also means retail members are incentivized to promote the payment method, because it is designed with consideration for what merchants consider most valuable: consumer data.

Starbucks

Starbucks continues to be the unlikely leader in mobile payments, to the tune of $1.5 Billion in transaction volume, or 15% of all transactions in the United States (6 million transactions per week).

Starbucks mobile app has altered the course of mobile payments, proving that loyalty is a driving force for mobile adoption. By combining loyalty and digital stored-value Starbucks created a model which is the envy of many retailers and technology companies. According to Starbucks’ CEO, they are receiving numerous request to white-label their app for other QSRs.

Just how far ahead of Apple is Starbucks? According to Wired, each of the 1 million Apple Pay users who registered in the first few days of the launch would have to buy a cup of coffee every day to match Starbucks weekly transaction volume.

Mobile Payments will take over… in time

The sheer number of viable mobile payment methods means that for the next few years we won’t see a clear mobile payments champion. In addition to those I’ve briefly covered here there are several well-known startups including Square, Clinkle, and Coin. Some are apps, and some are programmable cards. Samsung is yet to respond to Apple Pay, but it is coming. Several friends at Samsung have been working on this since mid-2014, so it won't be long before Sammy's massive market share further accelerates mobile payment adoption.

Though it is unclear who operate the dominant mobile payment method, consumers will continue to use more than one for the next few years.

Looking Forward to 2015: Part One

Last year saw some major disruptions begin to take hold in finance and payments. While the jury is still out on some of these disruptive technologies like Bitcoin, others are going to continue to reshape entire industries including mPOS and a host of mobile payments options from Apple Pay to Coin.

Bitcoin or Bust in 2015?

As did many people, I got very excited about Bitcoin in 2014. I watched some documentaries, read some books, downloaded some apps…. As I dove deeper into this incredible technology the more I wondered if it could really turn the corner, become mainstream. Bitcoin certainly made steps forward toward becoming mainstream, including integrations with Paypal and recently Microsoft (sort-of). Coindesk, and important source of information about the crypto-currency, publishes and maintains a list of ways you can use bitcoins to make purchases. However, while at first glance it is impressive, considering the currency is only a few years old. there are some important retailers (most?) absent from the list.

Bitcoin’s biggest problem has been price volatility (aside from highly publicized thefts). Key to solving this will be an increase in real transactions. More retailers accepting bitcoin means more transaction volume, and the general reasoning goes that the price of a bitcoin will then reflect that transaction volume rather than speculative trading causing spikes in the crypto-currency’s price.

Yet despite the philosophical reasons why many people choose to use bitcoin, many people are attracted to bitcoin and other crypto-currencies by stories of massive fortunes being made out of seemingly thin air. As the price stabilizes (it hasn’t, it’s been going down most of 2014 and is now at around $280) we may see less people attracted to the currency as its attractiveness to speculators wanes. PYMNTS recently published a nice overview of Bitcoin’s interesting 2014, and the conflicting views for its future in 2015.

Challenges aside, the technology behind bitcoin… um, Bitcoin(?)... is truly revolutionary and lot’s of investment is pouring in. There are thousands of startups (more than 500 on Angel List alone) working with bitcoin. We’re probably passing over the hype-hump, and coming down to reality where real innovation is going to get traction, companies like Ripple or Blockstream.

In 2015 new innovations using the Blockchain to create “sidechains” like Blockstream, or bitcoin inspired technologies like Ripple’s protocol, may become the true legacy of Nakamoto. Some of the most notable entrepreneurs and investors in the Valley seem to think so.

The Unstoppable mPOS

While mPOS growth was steady it’s unlikely anyone in the mainstream had it pegged as one of the most disruptive technologies of the next couple years. That is, until millions of credit card and other personal information was hacked from major retailers in 2014. Right?

Wrong. 2014 seemed like one of the worst years for privacy in history, but it wasn’t. Starting the year off with Target (which really happened in 2013, but anyway), we saw Staples and Home Depot have severe security breaches, not to mention Sony. It was bad, but it may have been exaggerated. In fact, since Target was hacked in 2013 and can be excluded from any lists of 2014 data breaches… other than Home Depot (maybe) the 2014 hacks don’t make the top 5 according to CNN. 2013 probably cost more, an estimate $7.1 billion; and according to credit card fraud fraud in the U.S. accounted for 47% of all credit card fraud worldwide in 2012.

The real story in 2014 was the U.S. payments industry is finally making changes to address problems which have seen data breaches as severe or worse than 2014’s since the 80’s. Mastercard and Visa both announced that as of October next year they will be penalizing merchants for fraud that occurs because the retailer does not have an EMV payment system. This has prompted retailers, payments processors and acquirers, retail software companies, around the world to take action, fast. The migration to EMV alone is going to cost billions of dollars in spending, and has many retailers looking at mPOS as their next upgrade. The resulting displacement of entrenched incumbents could mean untold fortunes for challengers.

mPOS is at the center of a dramatically changing payments landscape. Startups like Square, ShopKeep, Revel Systems, or Poynt arguably have a headstart on entrenched giants like Verifone, NCR. In addition to the accepting EMV, the advantages of mPOS are cost (they’re cheaper), integrated software for inventory or marketing, they arguable reduce wait-time (at least at restaurants), and may even increase sales due to reduced abandonment. Some major players like First Data and Heartland Payments are beginning to acquire mPOS startups to gain an advantage. PYMNTS recently published an excellent overview of the advantages of mPOS, what the incumbent POS providers are doing about it as well as some of their challengers.

Bottom line is more than half of retailers surveyed by RIS (Retail Info Systems) plan to buy one or more mPOS for the next upgrade, and 25% say they are going to decrease spending on fixed POS. The number is higher when you look specifically at restaurants. Business Insider estimates the share of U.S. retailers who implement mPOS is going to grow up to 50% by the end of 2015, and reach almost 80% by 2019.

Expect to see lot’s of new mPOS systems in 2015… not to mention most of your favorite stores accepting one or more type of mobile payment method [to be continued].

Ditching Our Wallets for Mobile

I’ve been a fan of brick-and-mobile for years, and looks like the competition to win that space is getting more interesting. Paypal, Amazon and Google, have all been making major strides toward mobile payments. Apple is expected to make announcements soon, with rumors flying about NFC support and a new mobile wallet. Apple has also been working with Qualcomm’s Gimbal to deploy a BLE platform reportedly for brick-and-mobile commerce.

SK Telecom’s own subsidiary SK Planet --disclaimer, this is where I work-- has also entered the fray with the new Slyde app in the USA and Syrup in South Korea. Both of these are using a mix of awesome proprietary BLE technology, and in Korea Syrup is using NFC (which is an old hat in Korea, I could live with just NFC here if I tried) as well.

Amazon’s Buzz Kill

Jeff Bezos is faltering… at least for now. The fire phone (or whatever) is terrible, even if it wasn’t a blatant maneuver to get consumers to buy even more on Amazon. This mobile play is accompanied by a new Amazon Wallet, which is available for Android devices and let’s people upload gift cards to manage their stored-value payment arsenal. Nice move by Amazon, but seems like many consumers are peeved that Bezos Co. keeps coming after their personal information en force. Several people can be seen complaining about Amazon on various forums, and they are not alone.

Even Walmart is annoyed at Amazon. Perceiving the Kindle Fire as a “trojan horse” the company hasn’t been selling them... apparently since 2012. And given Amazon’s history the new mobile wallet could get a reputation for using payment and gift card purchase history in order to… yup, get you to buy more recommended stuff on Amazon products.

Google Wallet Lackluster

I like Google Wallet and there is a lot of potential there, but so far it is lackluster. However, the super-tech-star is really smart about their payment rep. Unlike Amazon, Google is positioning their payment solution along-side all the others… including Carrier Billing, and now PayPal.

While there isn't a lot of talk about Android and BLE in the US (Apple gets most of the coverage it seems), Android and NFC go together like peas in a pod. And if South Korea is any indication adoption will accelerate soon. A host of devices have NFC support, so it is really a matter of time before enough retailers have an NFC enabled POS in the US.

Apple Bites...

…on some of that smartphone market share. Or that would be my prediction for 2015. I think it is likely Apple is going to nail mobile payments in the next year and that the superior experience could lead to a slight bump in market share. Despite the naysayers, if Apple nails the mobile wallet… yeah a lot of people are gonna want it.

With the rumored introduction of NFC and the rolling-out of a massive BLE network with partners such as Qualcomm and a host of retailer partners we could see Apple pave the way for real mobile wallet adoption in the USA.

SK Planet

A fairly large player in Korea, and lot’s of experience in commerce here, SK Planet is making a mobile commerce push into the US. Though the combined population of Los Angeles and the Bay Area would probably be about the same as the population of South Korea… that doesn't mean you can ignore it. NFC payments and smart chips in credit cards are old hats here (to the tone of at least 8 years) while neither technology has real traction in the US. After years as part of SK Telecom, and the fact that everyone who works here uses NFC and smart-chip credit cards everyday (as does just about everyone in Korea), I believe what the company lacks in market presence it can make up with experience.

Currently in beta, SK Planet's US affiliate's mobile wallet, the new Slyde app (www.slydenow.com), could be more broadly available later this year. In Korea the Syrup app (previously called Smart Wallet) just launched BLE enabled services in limited locations near Seoul, adding to the already successful loyalty card wallet and coupon clipping features available since June this year.

Haters Gonna Hate

There are still lot’s of naysayers who believe the traditional wallet will not be replaced by the mobile wallets. They all seem to be in the USA, while almost anyone in Korea agrees that it is just a matter of time. That’s because of two realities here: smartphone penetration, and nearly ubiquitous NFC payment options.

Naysayers claim that cash is available everywhere and that mobile wallets on smartphones “haven’t even come close” to the same level of acceptance. That may be true in the US, but consider that in Korea smartphones enjoy 90% penetration and 100% of people riding the subway are using NFC payment already. Not to mention probably 100% of young consumers are using either T-Money, Cashbee, or some other method of NFC payment at a host of places everyday.

In fact the problem isn’t getting people to move from cash, the problem is getting people to move to an app when they already have a card or phone or both that is enabled via smart-chip or NFC to make payments just about anywhere. So enough with the C.R.E.A.M. defense against mobile wallets. If Korea is any indication of a mature "mobile" economy, and arguably it is more so that the US, the future is bright for mobile wallets.

Personally, once a mobile wallet app is ready which truly makes my credit cards go away, my wallet is going in the trash. We are getting closer every day to when we only need our phones, and I can’t wait. It’s so close that the last time I went to the airport I consciously decided not to buy a wallet, because I knew it would be outdated soon.