Is the Mobile Payment Tipping-point Approaching in the US?

If recent surveys regarding mobile wallet use are accurate, the mobile payment boom is about to happen. The next two years could see a rapid adoption of mobile wallets among credit card holders, causing a paradigm shift in the way we make purchases offline and online.

20% of US Customers Are “Likely” to Load Their Credit Card into a Mobile Wallet

According to Business Insider’s Intelligence Unit the potential number of adopters of mobile wallets in the United States, among consumers with credit cards, is growing fast. The survey measured credit card holders’ negative and positive intent to store their credit card information into a mobile wallet as “Not Likely” or “Neutral,” and “Likely” or “Definitely” respectively. They also measured the number of people who “Already Have” stored credit card information into a mobile wallet.

If this data holds true, it’s likely we are on the precipice (FINALLY!) for a mobile payments boom in the United States.

Scenarios for a Mobile Payment Boom

Scenario One: Entrenched Laggards, Constant Growth of Positive Intent

My first impression from this chart by BI Intelligence was that there is a wave of mobile payment adoption coming among credit card holders. However, we need to make some assumptions to see how rapidly this wave is approaching. First, let’s try to get a grasp on the situation.

Key Assumptions:

- 33% of respondents who say they are “definitely” going to load their credit card DO

- 33% of respondents who say they are “likely” to load their credit card DO

- People with negative intent (“Not Likely” or “Neutral”) will remain fixed

- YoY Growth for positive intent will remain constant

In this What-if scenario, we can clearly see that the number of people planning to store credit card information in 2017 will likely increase at a faster rate than previous years. At a constant rate of YoY growth in positive intent only 95% of the population is represented. It is also likely the laggards will continue to decrease over time though we have kept them constant in this scenario.

Furthermore, if we reduce the number of people with positive intent who actually load their credit card -- conversion -- from one in three (33%), the growth rate for people who are “Likely” or “Definitely” going to use a mobile wallet must increase even more dramatically.

Scenario Two: Laggard Floor, Moderate Conversion

Let’s modify our key assumptions to create a scenario where we have a moderate conversion from intent to action and growth in positive intent, but a similar distribution of responses over time.

However, let’s also assume there is a floor for laggards who show negative intent.

Key Assumptions:

- 33% of respondents who say they are “definitely” going to load their credit card DO

- 20% of respondents who say they are “likely” to load their credit card DO

- The sum of negative intent (“Not Likely” or “Neutral”) cannot be less than 16%

In this scenario we get a picture that’s more believable. We see a spike in positive intent next year, and have adjusted the growth of positive intent moving forward so we get a similar distribution among “Likely” and “Definitely” reponses. At the same time, assuming a moderate conversion rate (one in five, and one in three respondents respectively) among people with positive intent, we see a nice growth curve among those who “Already Have” stored their credit card information into a mobile wallet.

Among those consumers who have already stored their credit card into a mobile wallet, how many do we think have transacted? In general we see a drop in retention of 33% for any major step along an experience. That leaves us at 66% of people who stored a credit card on a mobile wallet, transact with a mobile wallet; which is about what we would expect based on media reports on Apple, Android, and Samsung Pay use among consumers who can use the service.

Does this seem like an aggressive forecast? Not really. If this is correct, it puts consumers transacting with a credit card via a mobile wallet around 30% in 2019.

In other words, half way through the Early Majority stage on the Diffusion of Innovation scale.

Does this mean my Mobile Wallet is about to be really successful?

It’s unclear what success means, but certainly it means a paradigm shift in the way people transact in less than five years. There are many companies banking on this shift, hence the options for consumers are growing as the market is becoming more fragmented.

Currently, most players measure success by number of registered cards, number of transactions, and the value of those transactions. However, profitability for mobile wallets is something still in the future, though certainly that future is less distant today.

How long can you stick in the fight?

Many traditional financial institutions will continue to see their mobile wallet as a value-added service, while customers who are over-served by those institutions will adopt alternatives with superb mobile experiences. Eventually, those alternatives are likely to move up-market taking away more of the retail banking market from traditional financial institutions.

Are you focusing on a superb mobile experience?

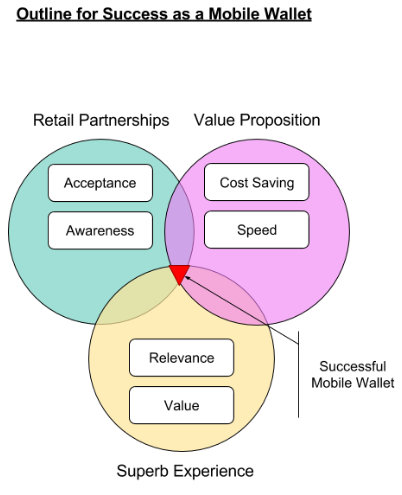

Of course, your payment service is worthless without acceptance. It is essential to have great retail partners who are part of the daily lives of your target audience. And while acceptance is key, so is awareness of your mobile wallet.

Most iPhone 7 users who have a credit card stored on Apple Pay fail to use it because they simply forget it is an option or they don’t know it is. Of course, universal acceptance would resolve this… but until you can get that (please don’t hold your breath) making sure your customers know where your mobile wallet is accepted is critical.

Combining these two critical factors, Acceptance and Awareness, into a superb mobile experience will mean you have a shot at catching onto and riding that wave of mobile wallet adoption.

Can you monetize enough?

The question still remains, how can you monetize your mobile wallet even with a wave of new customers? The recipe for success in consumer-facing mobile payments is still unclear.

There is a plethora of business models and new technologies being experimented with all the time by dozens of players across the payments value chain. Many of these are designed to reduce cost and generate income from that savings, others are designed to create more value by offering discounts or loyalty rewards, while others promise a faster checkout, or try to provide instant settlement.

The list of players is long and diverse. In nearly every country in the world there are several mobile payments players including banks, startups, telcos, retailers, and OEMS. There is a different recipe for each of them.

Ultimately the winners in each market will be those services which can combine Acceptance and Awareness, with a Superb Experience, and a unique Business Model which leverages New Technologies that address cost and speed. I wouldn’t call that a recipe, but perhaps you can call it an outline.

Is RCS Really A Sleeping Giant

Republished from my LinkedIn profile

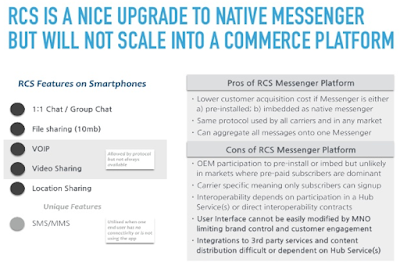

RCS promises to be a major upgrade to the Native Messenger on your Android smartphone. But is all the talk about a Sleeping Giant over blown?

RCS vs. OTT Messengers

RCS, or Rich Communications Services, is a protocol that's been around for several years. It allows carriers to provide services like Voice and Video Calls, File Sharing (think Photos), and of course Chatting 1:1 or as a Group. The problem with RCS for years was that it requires Interoperability between carriers, otherwise end users can only use the messenger among friends on the same network. These contracts take time and create a complicated user experience (Johnny: "Why didn't you get my text?").

Jibe Mobile created a Hub to allow carriers to create one NNI (Network-to-Network-Interface) with their communications service in order to create interoperability with any other carrier also connected to the Hub, provide they used their white-label messenger (Messenger Plus). They offered colourful skins so carriers could "customise" the user interface. Google acquired Jibe last year, and at MWC a few weeks ago they made some announcements. Yippie!

Google's new platform is great, don't get me wrong. However, it is great as an upgrade to the native messenger available on your Android smartphone if it supports RCS (btw only a fraction of all Android devices currently support it, though that will certainly change). The idea that RCS will emerge as a rival to OTT Messengers like WhatsApp, Facebook Messenger, or WeChat (not to mention Instagram, SnapChat, or anything else new that "tweens" are using) is unfounded in reality, or really optimistic.

The bottom-line is people use OTT Messengers (like other social media) because their friends use it, it's personal, it's unique, and often it's private -- or at least more private than your Google-provided messenger. And more than ever, OTT Messengers are evolving to rival not SMS or other Communication tools, but Operating Systems themselves. They are the new layer upon which all m_commerce is being built... or rather integrated with.

If App distribution was broken before, it's dead now. The tops apps are almost always Facebook, Google, or Apple (or some other usual suspect). Services, both private and public, don't have the time or money to compete with those giants for audience. Enter the OTT Messenger with a dedicated audience that's big and local. On-demand services, eCommerce, traditional businesses, public services, payment (p2p, c2b, and even c2g) can all be integrated to the OTT Messenger. And these integrations can be surfaced, or not, based on wherever the user is. WeChat is a great example of this, and they are pushing into Subsaharan Africa something fierce with their major shareholder Naspers. That's significant in several ways, but in terms of the above examples that means millions of people who are already using their phones to pay for everything. A nudge may be all it takes to put WeChat and Naspers at the centre of m_Commerce there similarly to how WeChat has positioned itself in China.

In addition to services, OTT Messengers are ideal for content distribution which drive downloads for other types of apps. This could be anything, literally.

So sleeping giant? Maybe, those guys at Google are obviously creative and smart. We'll see what they come up with. But on the face of things, Google's new Jibe makes for some fancier Native Messengers, but will hardly impact the impressive rise of OTT Messengers to the centre of our smartphone experience.

Checkout some clips from my slideshare below or see the whole thing:

http://www.slideshare.net/malesniak1/rcs-vs-ott-messengers

http://www.slideshare.net/malesniak1/rcs-vs-ott-messengers

Bluetooth Mesh Networks for Retail

Disclosure: I currently work for SK planet, a wholly-owned subsidiary of SK telecom, one of the companies which sets Bluetooth standards.

The Bluetooth Special Interest Group (SIG) confirmed the introduction of new standards to support mesh networking via bluetooth. There were a few startups like Ubudu and Zuli.io that didn’t wait for the standards and these innovators are the first-movers in creating futuristic customer experiences with bluetooth mesh networks. Now that the standards are out, and it’s a watershed moment for IoT.

Bluetooth Beacon Mesh Networks

A mesh network could hypothetically extend the range to whatever distance you need. When a beacon is stand-alone it can advertise itself up to a few meters. Even with two-way communication (transmitting or receiving small packets) the potential utility of the beacon is limited to hyper-localised use cases. For example, while near a beacon in a store the client can request specific information about that location from the server; or, perhaps I could use my phone to turn on/off a lamp while near that lamp.

| Bluetooth Smart Mesh Network |

A mesh network allows me to extend the range by linking the beacons together. It accomplishes this in two ways: 1) by routing directly to a beacon somewhere in the network to enable a specific experience (e.g. turn-off the kitchen lights downstairs); or, 2) by flooding the entire network or a subset within the network to create an experience using multiple beacons (e.g. set living-room to mom’s profile). Using a mesh network subsets can also be created allowing for unique experiences for connected devices within a specified subset of the network.

Futuristic Consumer Experiences

Smarthomes have been all the rage for a couple years now, and the new standards for mesh networks will accelerate that. However, there are some exciting opportunities for retail consumer experiences as well. Here are a few ideas for implementing bluetooth mesh networks for in-store experiences.

Custom Subsets or “Rooms”

Custom subsets are probably the most well known IoT use case that leverages a mesh network of beacons. This is the oft given example of Smart Homes: dad walks into the living room, the lights dim and TV switches to Bloomberg News. The living room is a subset within the network, and the settings of all devices within that subset can be adjusted to fit the preference of a user. Additionally, a hierarchy of users can be created (i.e. Dad overrides son) and those settings can be engaged simply by walking into a room.

| Experiences Adapt To You From Room To Room |

In retail, you can easily imagine this being used to create unique experiences at furniture, luxury audio and video showrooms. The question remains, how is this triggered? An end-user with a smartphone application is the answer most of the time today. Whether or not the use is a customer or salesperson is another question. On the one hand, the lure of customising your own experience while in a showroom could tempt customers to download your software, it may be more efficient to create software for clienteling.

Shopping Efficiency

How much time have customers wasted trying to find products within large department stores, shops within large shopping malls, or the toilet? Networked signage could be used to assist customers and make their journey more efficient. A customer could select the target destination within an app on their smartphone or on a digital sign. As he travels through the store or mall, visual cues can be triggered to guide the customer on his journey.

| Signage Alerts When You Arrive |

These cues can be in-app via notifications (“you’re going the wrong way”) or via digital signage (“Customer XYZ here is your destination”). In this use case, a mix of proximity technology like geomagnetics or wi-fi would be the best way to guide customers. However, incorporating visual cues will reassure customers and probably create new opportunities to surprise and delight them.

Personalised Signage & Electronic Labels

Networked Signage and Electronic Labels are another opportunity for retailers and customers. A label which displays a price with e-ink can dynamically display discounted prices to customers subscribed to loyalty programs or with a digital coupon. In fact the packet-size of data needed to display a price is small enough it should be possible without the internet. A networked electronic labels could dynamically generate prices for a section of a shelf, so customer can compare discounts on multiple brands.

| Dynamic Prices On Electronic Labels |

More dramatically, personalised media could be presented to customers at any digital sign. Digital Signage connected to a mesh network could request content from the cloud via the network.

Dynamically Adjust to Audience

With enough connected signage and labels, retailers could abstract further to create experiences for audience types. For example, customers of a given profile at a given time of day within a given store could tend to coalesce within a certain subset of a mesh network. At the same time another group of customers of a given profile could coalesce within another subset. This would allow for digital experiences within either subset to be tailored for those audiences.

| Flooding Subsets To Adapt For Audience Profiles (Green vs Orange) |

In Conclusion

Without a doubt the experiences retailers can create leveraging bluetooth mesh networks will be essential to the success of their mobile software. A few technology startups like Ubudu and Zuli, as well as large companies (SK telecom among them) are already moving to make bluetooth mesh beacons a commodity. Digital Signage will be the obvious choice for retail, but the real question will be what unimaginable use cases will creative marketers invent for mesh beacons? I’m not simply referring to engaging content on a screen, but beyond that what new devices will we connect and how will they create more value and efficiency?

2015 NRF Big Show Recap

The National Retail Federation’s 104th Annual Big Show was amazing. More than 35,000 executives and the like attended the world’s largest expo for retail. It was my first show, and it was truly awesome. I came back with several new perspectives and insights, as well as reaffirmed confidence in the trajectory of omnichannel retailing. For me, this has been an area of interest for several years so it is exciting to final attend in the Big Show, and see how quickly we are approaching the vision for the Future of Retail -- something many of us have been working for since 2009 or even earlier.

My high level takeaway is that omnichannel retailing is the evolving standard for retail. Retailers will implement a variety of tactics to further implement Omnichannel into their business and marketing operations, with In-Store Experiences central to most aspects of their Omnichannel strategy.

Omnichannel

Omnichannel is an evolving new standard for retail which prioritizes the customer, which requires business practices to adapt to a complex customer journey and marketing practices to adapt to a new “segment of one.”

Fulfillment: Omnichannel fulfillment is a major issue for retailers. This requires Real-Time Inventory accessible from all stores, in-other-words centralized; Distributed Order Management, or the ability to accept and fulfill orders (and update inventory in real-time) from across channels: online, mobile, in-store. This enables drop-shipping from local stores to reduce fulfillment time (online orders); recommendations for local stores where desired inventory is in-stock and can be purchased for pick-up (mobile); have an item shipped from the store, or have an item in a different size, color, etc shipped from a different store for pick-up at a local store or directly to the customer (in-store). Some good examples of omnichannel fulfillment included Netsuite’s “Customer Commerce”

RFID: Omnichannel fulfillment can be implemented without RFID, but achieve the full promise of Intelligent Fulfillment technology such as RFID will be necessary. Real-Time logistics and inventory data, as well as in-store tracking of products and even people (e.g. Intel presented an in-store tracking solution which integrated RFID into a shopping bag), as well as unique customer experiences which simply product discovery and savings.

Segment of One: Aggregating Individual Data combined with Granular Data in Stores, Distribution Centers, and up the Supply Chain will allow for segmentation on an individual basis. This will fulfill the promise of personalization where predictive models based on averages have failed. Technology innovations for real-time inventory and in-store tracking will help, but gaining customers to provide individual data requires stores to innovate around consumer experiences to create value. IBM’s description of Segments of One is comprehensive (if generic), but this goes beyond a profile. Stores and consumer software should provide relevant experiences by determining the context of the store visit: Is she in a rush? Is the dwelling? Is she lost or not sure what to buy?

Actionable Data: Collecting and aggregating data from inventory, in-store tracking, etc., provides information; individual data allows us to determine context which makes data actionable. To gain individual data consumers must perceive value proportional to the risk of providing the information. Value can be created via Savings, Efficiency, and Engagement. Some examples: 78% of customer report they would like to view signs with special promotions (savings), and 67% favor in-store guidance through digital signage (efficiency).

Integrated Data: Breaking down silos is critical to realizing a truly omnichannel store, and the burden rests heavy on software providers. Data must become unified from customer-end to supplier-end and made available to the retailer for real-time analytics. A variety of middleware options to help software vendors integrate data are emerging: e.g. Mad Mobile, Highjump.

Retail Devices

Retailers will purchase a variety of devices that align to their omnicommerce strategy.

Kiosks: A low-hanging fruit for retailers, new kiosks will be installed in 2015 for a variety of use-cases including: bill payment, interactive-tabletop, assisted selling, reporting and personnel management. Both Microsoft and Samsung demonstrated new kiosks, and made partnership announcements: Hardee’s and TGI Fridays will deploy self-order kiosks (Microsoft); Freshwater and ComQi will partner with Samsung to power assisted shopping.

Digital Signage: Arguably the second priority for retailers -- after actionable data -- retailers will quickly adopt digital signage as a low-hanging fruit to implement new in-store experiences as part of their omnichannel strategy. Two of the most impressive exhibits at NRF ‘15 were eBay’s Magic Mirror and Memomi by Memory Mirror (Palo Alto-based startup). Integrating digital signage with real-time data analytics, inventory and fulfillment, and presence technology will be an important part of most retailers omnichannel strategy, if not aspirational since truly integrated and actionable data is still a goal, not a reality, for most (all) retailers. Scala, Lexmark, Toshiba, Samsung, also had noteworthy digital signage exhibits. Lexmark is expected to rollout at Bestbuy, Office Depot, Safeway and 70+ more retailers.

Electronic Shelf Labels: A variant of digital signage, ESL could be a quietly emerging trend. There were two varieties of ESL, one which uses LCD strips to display a variety of content and another which uses e-ink to dynamically display essential information typical to existing labels. The displays can be invoked by presence technology, facilitating dynamic pricing (for example) based on digital coupons stored on a mobile app.

Printer Integration: There were two solutions that addressed our printer integration problem. Ecrebo, a UK based company, which provides an SDK to interface with any printer. The other, Counect, was featured at Intel’s booth and solved the same problem using hardware called Counect Cube. This device operates as a Smart Gateway which utilizes any form of connectivity be-it Ethernet/Wi-Fi/3G/Bluetooth4.0 to interface with the printer and capture transaction data along with customer data.

mPOS: There were a host of mPOS devices from traditional POS players, though Vend and First Data’s Clover were also on site. Retailers will procure devices capable of a variety of payment methods in addition to EMV and Contactless Card. Microsoft Windows 8 POS on notebooks, desktops, tablets and phones were common as well as pairing with iPhone and Macbooks. 1D Laser Scanners, CCD Scanner, 1D/2D Image Scanners, NFC. Zebra Technologies exhibited a variety of Motorola mPOS (acquired), and Korean makers POS BANK and Bluebird had a strong presence.

In-Store Analytics

There is a wealth of information being acquired, and retailers are quickly implementing more strategies to gain better insights across multiple channels and locations. Understanding what is happening in-store is helping retailers improve marketing, assortments (merchandise), staffing, and fulfillment.

WiFi, Beacons, Cameras: Numerous companies exhibited In-Store Analytics solutions which leveraged WiFi, Bluetooth, or Cameras; the majority of them deploying devices integrating one or all of these. People Counting (check-in), Window Display Effectiveness, Customer Journey Tracking, etc. These solutions are packaged as engagement and staff management solutions, but typically were not integrated with inventory, personnel management, or CRM. Some standout companies were Nomi, Airwatch (VMWare), Euclid and RetailNext; however, there is a clear opportunity to provide truly end-to-end solutions. It is also important to note that several data science and analytics companies are forming close partnerships with device (wifi, beacon, camera) manufactures indicated consolidation is possible if not likely.

Retail Growth Strategies

Retailers are eager to grow amidst a global recovery, low cost of transportation of goods (aka cheap oil), and newly emerging markets (Southeast Asia, Africa). With intensified competition from both incumbent online retailers as well as brick-and-mortar retailers they are employing strategies to gain market share and differentiate themselves in ways that go beyond technology.

Diversification: Major retail brands are diversifying their brand with new products and services. For example, Birchbox launched a brick-and-mortar store where customers can take home product samples in addition to purchasing. Ralph Lauren opened a new flagship featuring Ralph’s Cafe, and Lululemon launched men’s line with an in-store grooming parlor.

Going Big: Several retailers presented on strategies for going global. The consistent was to do it, and do it big when you do. Launching 200 new locations as part of a regional expansion strategy was preferred to (for example) 10 new stores in the UK alone.

Storytelling: An extension of in-store experience, retailers will strive to differentiate amongst themselves and -- importantly -- against online retailers by providing a story to customers. The objective is to transform brick-and-mortar into a destination.

Examples of Future Stores

There were a few outstanding examples of technology implementations. Among them, standouts were Rebecca Minkoff, Intel, IBM-Apple, and Microsoft.

Rebecca Minkoff: Hands-down the most complete demonstration of “The Future of Retail” the store implemented useful technology to enhance the In-store shopping experience.

IBM-Apple: IBM launched its MobileFirst for iOS retail enterprise apps Sales Assist and Pick & Pack. Each are powered by Watson, and are part of a new suit of enterprise apps which will include apps for banking, retail, insurance, financial services (insurance), telecom, government, and airlines.

“The Sales Assist app lets sales associates check customer profiles and make shopping suggestions based on purchase histories, as well as check in-store inventory, locate items in-store and arrange to ship out-of-stock items to the customer. The Pick & Pack app, meanwhile, combines in-store proximity-based tech (beacons) with back-end inventory insight to improve order fulfillment, and is 70% ready to go out-of-the-box.” - brandchannel

Microsoft End-To-End IoT: Azure HDInsight and Power BI for Office 365 makes it easy for retailers to track revenue, product searches, customer purchasing, social media activity, etc. Can easily access Power Map for Excel to represent responses to online ads, comparing by region or IP. Kinect for Windows is used for in-store tracking of product and customer movement where data is analyzed by Azure Stream Analytics. Azure Machine Learning can make predictions about individual consumers purchasing interests in coming days, weeks, months; and manage inventory in departments, stores, or region. - Microsoft Blog

Conclusion

Though the full vision of an omnichannel store is still aspirational, investments by retailers and vendors are bringing that vision closer to reality than ever before. This new paradigm in retail --a real-time, data driven, customer-focused, destination-creating, renaissance-- is evolving. I guess that means next year I can go back to New York? Hope so!

Frankly The Best "Ephemeral" Messenger

Disclaimer! SK planet is an investor in Frankly Inc. but this is in no way a “native advertisement” nor is it an official position of Frankly, SK planet, or any other business partner. No one asked me to write this, I just really like the app and want to write about it. Also I may be biased… but seriously Frankly is still awesome and you should download it right now anyway → iOS Android

Since reading No Place To Hide, a great book about Edward Snowden and many of his revelations, I started to feel less comfortable with how Google, Facebook, or (since I live in Korea) Kakao, and most social media companies were storing my data. Naturally, a lot of people felt that way making anonymity the new black according to Digiday.

Around that same time SK planet invested in Frankly. Since I work at SK planet I’ve had the opportunity to have several great conversations with the amazing people at Frankly, and I know for sure that privacy is top-of-mind and that none of their users messages are stored. They set out to liberate social networking with a secure, snoop-proof messenger platform, period.

What’s Behind Frankly

The idea behind Frankly was that people should have a platform where they can chat frankly with each other without concerns that their conversations are being recorded. Bottom line philosophy at Frankly: our conversations on messengers should be at least as secure as conversations IRL (“in-real-life”).

Frankly gives you total control of your conversations and promises they are ephemeral so you can chat freely. Not too mention that you will have a fun and compelling experience too. To accomplish that they have built a first class team that shares this philosophy, raised more than $20 million, and recently IPO’d in Toronto. Frankly has the runway to make their vision of a liberated social networking experience as reality.

Compelling and Secure

It can be tough to adopt a new messenger, but by making the experience compelling and totally secure Frankly has empowered early-adopters to stick it out and get their friends on the app. First, your messages will disappear forever after a few seconds. The the app also looks awesome, plus it’s really easy to customize the way your chats look and feel. You can also “pin” your messages so if you want to remember some important info or context that’s totally possible (which I think is a really neat feature), and remove sent messages you didn't mean to send or rather you hadn't sent. Of course you can also share photos, and they will evaporate as well.

Frankly is probably the best application for group chats. When you enter a group chat on Frankly, your messages are anonymous. This is the most liberating aspect of Frankly, and it makes it a great tool for candid conversation among friends and co-workers, or between brands and customers.

Savvy Partnerships To Realize The Vision

Getting user adoption for any app is hard, and for messengers it is really hard. In addition to its own messenger app, Frankly means to achieve their vision of liberating the chatting masses through partnerships. Their SDK is available for any business that shares their philosophy and wants an easy implementation of secure, private, anonymous messenger for their customers.

Last year Victoria’s Secret integrated Frankly’s SDK into their Pink shopping app. The app made it possible for customers, who might be concerned about their privacy whilst chatting-up and sharing photos of lingerie, to engage with the brand with texts, customizable emojis, user photos, and multiple shades of pink.

Models were even available for live chat!

Models were even available for live chat!

Overall My Favorite Messenger…

I really love this app, for being awesome and for executing a strategy that is aligned with their core-values. It’s too bad because more people I know aren’t on it yet, but hopefully that will change in 2015. If you’re a business who cares about your customers, get the Frankly SDK. It's a particularly good idea for retailers who want to integrate social networking into their omnichannel strategy, because they can reassure your customers the channel is secure.

Best of luck to the team, thanks for looking out for all of us, and congrats on the IPO!