Looking Forward to 2015: Part Two

While mPOS will drive significant disruption in 2015 for transaction processing, it is also enabling consumers to embrace mobile payments. That's because EMVco has designed EMV to work with NFC for contactless payments. The rise of Host Card Emulation (HCE), a term attributed to the founders of SimplyTapp, is also a driving force since it lowers the barrier for mobile payments by eliminating the need for hardware called a Secure Element (SE).

It’s all very exciting, and the bottom-line: mobile payments will become a force majeure among payment methods within a few years. Business Insider predicts US Mobile In-Store Payment volume will grow 172% for the next 5 years. Data compiled by Statista.com has breaking $700B by 2017.

Mobile Payments Become a Normal Payment Method in 2015

First, I wrote about this last year in a post about digital wallets, when Apple Pay was still a blip on the buzz-radar. Digital Wallets really needed mobile payments to come-of-age, and now they are.

Mobile payments got a huge injection of consumer confidence from the release of Apple Pay. Anyone would assume Apple’s share of global mobile payment transactions will be significant, eventually. But remember, there are several very real competitors. Just a few years ago many predicted that PayPal would “win” the mobile payments market, now Apple Pay is all the rage. The reality is there probably will not be any clear winners, not for a while anyway.

Mobile payments got a huge injection of consumer confidence from the release of Apple Pay. Anyone would assume Apple’s share of global mobile payment transactions will be significant, eventually. But remember, there are several very real competitors. Just a few years ago many predicted that PayPal would “win” the mobile payments market, now Apple Pay is all the rage. The reality is there probably will not be any clear winners, not for a while anyway.

Products like Softcard, MCX, Apple Pay, Google Wallet, and not to mention whatever Amazon is cooking-up, are all vying for transaction volume in 2015, with a tipping-point of relevancy approaching somewhere between now and 2017. Venture Capital, Credit Card Networks (Mastercard and Visa), Banks, OEMs, everyone seems to be making some bets on mobile payments.

Apple Pay

Apple is driving US merchant demand for NFC, period. Other solutions existed for years, but in the US they never drew merchant adoption en masse. That's not the case everywhere, in fact NFC payments are so common in South Korea that literally everyone uses some form of stored-value payment card which is enabled by NFC. However, the unique position of the US means global adoption is now underway.

US merchant adoption was slow until Apple Pay. Business Insider reported that VeriFone, the largest provider of countertop-terminals in the US, has seen a spike in sales of NFC enabled devices since the launch of Apple Pay. That said, Apple Pay is unlikely to become the leader in mobile payments in spite of the important role it plays in growing the market.

And in fact Apple Pay is not garnering the kind of adoption many had hoped for. Some reports show 1% of transaction volume on mobile can be attributed to Apple Pay, not bad I guess but nothing to really brag about. One report also showed that less than 5% of iPhone owners who could enable Apple Pay had done so, and among them on 30% had used it. That said, Wholefoods (one of the most popular merchants for Apple Pay) claims they are witnessing “significant growth” in usage. So there is a ways to go for Apple yet, but integration of BLE and facial recognition software not to mention the Apple Watch will all drive further use of this payment method.

And in fact Apple Pay is not garnering the kind of adoption many had hoped for. Some reports show 1% of transaction volume on mobile can be attributed to Apple Pay, not bad I guess but nothing to really brag about. One report also showed that less than 5% of iPhone owners who could enable Apple Pay had done so, and among them on 30% had used it. That said, Wholefoods (one of the most popular merchants for Apple Pay) claims they are witnessing “significant growth” in usage. So there is a ways to go for Apple yet, but integration of BLE and facial recognition software not to mention the Apple Watch will all drive further use of this payment method.

Google Wallet and Paypal

How do Google and Paypal feel about Apple Pay?

- Happy, because people with Samsung phones will start using mobile payments too!

- Frustrated, because they’ve had NFC mobile payments for years and nobody cared.

- Worried, because this means Apple will sell more phones.

For sure A and B. Not so much C.

Paypal and eBay split just weeks after the launch of Apple Pay. It’s unclear that Apple had anything to do with that, but it is telling. Paypal was once considered the front-runner, now they are just one in a peloton where Apple appears to be slightly ahead.

Paypal and eBay split just weeks after the launch of Apple Pay. It’s unclear that Apple had anything to do with that, but it is telling. Paypal was once considered the front-runner, now they are just one in a peloton where Apple appears to be slightly ahead.

Paypal has an advantage though, it’s really a payments company and builds at least some of the components driving the competition. Braintree, now part of Paypal, supports Apple Pay and enables it for merchants along with Paypal. Paypal has solid legs in mobile payments, announcing partnerships with Samsung, Microsoft, Blackberry (um, the third-leg?), and it works on every platform. Not to mention they own the coolest P2P payment app around, Venmo.

Google has stayed in the peloton on sheer force of will. Sources say they are running a substantial deficit with Google Wallet, desperately trying to get adoption. While Apple generates demand for NFC enabled terminals literally overnight, Google couldn’t pay merchants to enable NFC and accept Google Wallet for years. That's about to change.

Google Wallet represents 4% of mobile payments while Apple Pay is estimated at 1.7% (those numbers will probably increase rapidly in 2015 for both Google and Apple). Google Wallet is also available on iOS and supports TouchID. Google could conceivably ride the Apple Pay wave to attract iPhone users, and there is some indication this has already begun to happen. Since the launch of Apple Pay, Google Wallet usages is up 50% by some accounts. I can see Google using the powerful brand and software ecosystem to subvert Apple Pay even on iPhones, perhaps by managing receipts and bills in Google Drive. Google is already flexing its software muscles with APIs for Objects and Instant Buy.

Softcard

It’s hard to write better fiction than Softcard. The history of this telco-startup reads like historical-realism: US telcos launch mobile payments venture called ISIS, several months later a major terrorist organization called ISIS wreaks havoc on innocent people in Iraq and elsewhere, destroying all hopes of the ISIS mobile payment method becoming a household name.

Well, ISIS is a household name but that’s not exactly what At&t had in mind.

Well, ISIS is a household name but that’s not exactly what At&t had in mind.

Rebranded as Softcard and invigorated by Apple Pay, this digital wallet is signing deals with McDonald’s and Microsoft. While speaking at a conference the CEO of Softcard said he is excited about 2015 since “finally people know what my company does” thanks to Apple Pay. However, the road ahead is going to be filled with challenges for Softcard.

MCX

Apple Pay was the clear buzz winner in 2014, but MCX was a solid second. The Merchant Consumer Exchange (MCX) is a consortium of the largest retailers in the United States -- in some cases the world -- which has committed to launching its own mobile payment method in 2015. The total transaction volume for MCX members was estimated at $1 Trillion last year. MCX made headlines after Apple Pay was launched when some of the member retailers, including CVS, “unplugged” Apple Pay citing an exclusivity clause in their MCX membership agreement.

There were a slew of negative posts by Apple aficionados from well known tech news sites, but many of them exaggerated the situation. The reality is that MCX is in an excellent position because it is retailer owned, which means loyalty rewards can be built in. It also means retail members are incentivized to promote the payment method, because it is designed with consideration for what merchants consider most valuable: consumer data.

Starbucks

Starbucks continues to be the unlikely leader in mobile payments, to the tune of $1.5 Billion in transaction volume, or 15% of all transactions in the United States (6 million transactions per week).

Starbucks mobile app has altered the course of mobile payments, proving that loyalty is a driving force for mobile adoption. By combining loyalty and digital stored-value Starbucks created a model which is the envy of many retailers and technology companies. According to Starbucks’ CEO, they are receiving numerous request to white-label their app for other QSRs.

Just how far ahead of Apple is Starbucks? According to Wired, each of the 1 million Apple Pay users who registered in the first few days of the launch would have to buy a cup of coffee every day to match Starbucks weekly transaction volume.

Mobile Payments will take over… in time

The sheer number of viable mobile payment methods means that for the next few years we won’t see a clear mobile payments champion. In addition to those I’ve briefly covered here there are several well-known startups including Square, Clinkle, and Coin. Some are apps, and some are programmable cards. Samsung is yet to respond to Apple Pay, but it is coming. Several friends at Samsung have been working on this since mid-2014, so it won't be long before Sammy's massive market share further accelerates mobile payment adoption.

Though it is unclear who operate the dominant mobile payment method, consumers will continue to use more than one for the next few years.

Looking Forward to 2015: Part One

Last year saw some major disruptions begin to take hold in finance and payments. While the jury is still out on some of these disruptive technologies like Bitcoin, others are going to continue to reshape entire industries including mPOS and a host of mobile payments options from Apple Pay to Coin.

Bitcoin or Bust in 2015?

As did many people, I got very excited about Bitcoin in 2014. I watched some documentaries, read some books, downloaded some apps…. As I dove deeper into this incredible technology the more I wondered if it could really turn the corner, become mainstream. Bitcoin certainly made steps forward toward becoming mainstream, including integrations with Paypal and recently Microsoft (sort-of). Coindesk, and important source of information about the crypto-currency, publishes and maintains a list of ways you can use bitcoins to make purchases. However, while at first glance it is impressive, considering the currency is only a few years old. there are some important retailers (most?) absent from the list.

Bitcoin’s biggest problem has been price volatility (aside from highly publicized thefts). Key to solving this will be an increase in real transactions. More retailers accepting bitcoin means more transaction volume, and the general reasoning goes that the price of a bitcoin will then reflect that transaction volume rather than speculative trading causing spikes in the crypto-currency’s price.

Yet despite the philosophical reasons why many people choose to use bitcoin, many people are attracted to bitcoin and other crypto-currencies by stories of massive fortunes being made out of seemingly thin air. As the price stabilizes (it hasn’t, it’s been going down most of 2014 and is now at around $280) we may see less people attracted to the currency as its attractiveness to speculators wanes. PYMNTS recently published a nice overview of Bitcoin’s interesting 2014, and the conflicting views for its future in 2015.

Challenges aside, the technology behind bitcoin… um, Bitcoin(?)... is truly revolutionary and lot’s of investment is pouring in. There are thousands of startups (more than 500 on Angel List alone) working with bitcoin. We’re probably passing over the hype-hump, and coming down to reality where real innovation is going to get traction, companies like Ripple or Blockstream.

In 2015 new innovations using the Blockchain to create “sidechains” like Blockstream, or bitcoin inspired technologies like Ripple’s protocol, may become the true legacy of Nakamoto. Some of the most notable entrepreneurs and investors in the Valley seem to think so.

The Unstoppable mPOS

While mPOS growth was steady it’s unlikely anyone in the mainstream had it pegged as one of the most disruptive technologies of the next couple years. That is, until millions of credit card and other personal information was hacked from major retailers in 2014. Right?

Wrong. 2014 seemed like one of the worst years for privacy in history, but it wasn’t. Starting the year off with Target (which really happened in 2013, but anyway), we saw Staples and Home Depot have severe security breaches, not to mention Sony. It was bad, but it may have been exaggerated. In fact, since Target was hacked in 2013 and can be excluded from any lists of 2014 data breaches… other than Home Depot (maybe) the 2014 hacks don’t make the top 5 according to CNN. 2013 probably cost more, an estimate $7.1 billion; and according to credit card fraud fraud in the U.S. accounted for 47% of all credit card fraud worldwide in 2012.

The real story in 2014 was the U.S. payments industry is finally making changes to address problems which have seen data breaches as severe or worse than 2014’s since the 80’s. Mastercard and Visa both announced that as of October next year they will be penalizing merchants for fraud that occurs because the retailer does not have an EMV payment system. This has prompted retailers, payments processors and acquirers, retail software companies, around the world to take action, fast. The migration to EMV alone is going to cost billions of dollars in spending, and has many retailers looking at mPOS as their next upgrade. The resulting displacement of entrenched incumbents could mean untold fortunes for challengers.

mPOS is at the center of a dramatically changing payments landscape. Startups like Square, ShopKeep, Revel Systems, or Poynt arguably have a headstart on entrenched giants like Verifone, NCR. In addition to the accepting EMV, the advantages of mPOS are cost (they’re cheaper), integrated software for inventory or marketing, they arguable reduce wait-time (at least at restaurants), and may even increase sales due to reduced abandonment. Some major players like First Data and Heartland Payments are beginning to acquire mPOS startups to gain an advantage. PYMNTS recently published an excellent overview of the advantages of mPOS, what the incumbent POS providers are doing about it as well as some of their challengers.

Bottom line is more than half of retailers surveyed by RIS (Retail Info Systems) plan to buy one or more mPOS for the next upgrade, and 25% say they are going to decrease spending on fixed POS. The number is higher when you look specifically at restaurants. Business Insider estimates the share of U.S. retailers who implement mPOS is going to grow up to 50% by the end of 2015, and reach almost 80% by 2019.

Expect to see lot’s of new mPOS systems in 2015… not to mention most of your favorite stores accepting one or more type of mobile payment method [to be continued].

Ditching Our Wallets for Mobile

I’ve been a fan of brick-and-mobile for years, and looks like the competition to win that space is getting more interesting. Paypal, Amazon and Google, have all been making major strides toward mobile payments. Apple is expected to make announcements soon, with rumors flying about NFC support and a new mobile wallet. Apple has also been working with Qualcomm’s Gimbal to deploy a BLE platform reportedly for brick-and-mobile commerce.

SK Telecom’s own subsidiary SK Planet --disclaimer, this is where I work-- has also entered the fray with the new Slyde app in the USA and Syrup in South Korea. Both of these are using a mix of awesome proprietary BLE technology, and in Korea Syrup is using NFC (which is an old hat in Korea, I could live with just NFC here if I tried) as well.

Amazon’s Buzz Kill

Jeff Bezos is faltering… at least for now. The fire phone (or whatever) is terrible, even if it wasn’t a blatant maneuver to get consumers to buy even more on Amazon. This mobile play is accompanied by a new Amazon Wallet, which is available for Android devices and let’s people upload gift cards to manage their stored-value payment arsenal. Nice move by Amazon, but seems like many consumers are peeved that Bezos Co. keeps coming after their personal information en force. Several people can be seen complaining about Amazon on various forums, and they are not alone.

Even Walmart is annoyed at Amazon. Perceiving the Kindle Fire as a “trojan horse” the company hasn’t been selling them... apparently since 2012. And given Amazon’s history the new mobile wallet could get a reputation for using payment and gift card purchase history in order to… yup, get you to buy more recommended stuff on Amazon products.

Google Wallet Lackluster

I like Google Wallet and there is a lot of potential there, but so far it is lackluster. However, the super-tech-star is really smart about their payment rep. Unlike Amazon, Google is positioning their payment solution along-side all the others… including Carrier Billing, and now PayPal.

While there isn't a lot of talk about Android and BLE in the US (Apple gets most of the coverage it seems), Android and NFC go together like peas in a pod. And if South Korea is any indication adoption will accelerate soon. A host of devices have NFC support, so it is really a matter of time before enough retailers have an NFC enabled POS in the US.

Apple Bites...

…on some of that smartphone market share. Or that would be my prediction for 2015. I think it is likely Apple is going to nail mobile payments in the next year and that the superior experience could lead to a slight bump in market share. Despite the naysayers, if Apple nails the mobile wallet… yeah a lot of people are gonna want it.

With the rumored introduction of NFC and the rolling-out of a massive BLE network with partners such as Qualcomm and a host of retailer partners we could see Apple pave the way for real mobile wallet adoption in the USA.

SK Planet

A fairly large player in Korea, and lot’s of experience in commerce here, SK Planet is making a mobile commerce push into the US. Though the combined population of Los Angeles and the Bay Area would probably be about the same as the population of South Korea… that doesn't mean you can ignore it. NFC payments and smart chips in credit cards are old hats here (to the tone of at least 8 years) while neither technology has real traction in the US. After years as part of SK Telecom, and the fact that everyone who works here uses NFC and smart-chip credit cards everyday (as does just about everyone in Korea), I believe what the company lacks in market presence it can make up with experience.

Currently in beta, SK Planet's US affiliate's mobile wallet, the new Slyde app (www.slydenow.com), could be more broadly available later this year. In Korea the Syrup app (previously called Smart Wallet) just launched BLE enabled services in limited locations near Seoul, adding to the already successful loyalty card wallet and coupon clipping features available since June this year.

Haters Gonna Hate

There are still lot’s of naysayers who believe the traditional wallet will not be replaced by the mobile wallets. They all seem to be in the USA, while almost anyone in Korea agrees that it is just a matter of time. That’s because of two realities here: smartphone penetration, and nearly ubiquitous NFC payment options.

Naysayers claim that cash is available everywhere and that mobile wallets on smartphones “haven’t even come close” to the same level of acceptance. That may be true in the US, but consider that in Korea smartphones enjoy 90% penetration and 100% of people riding the subway are using NFC payment already. Not to mention probably 100% of young consumers are using either T-Money, Cashbee, or some other method of NFC payment at a host of places everyday.

In fact the problem isn’t getting people to move from cash, the problem is getting people to move to an app when they already have a card or phone or both that is enabled via smart-chip or NFC to make payments just about anywhere. So enough with the C.R.E.A.M. defense against mobile wallets. If Korea is any indication of a mature "mobile" economy, and arguably it is more so that the US, the future is bright for mobile wallets.

Personally, once a mobile wallet app is ready which truly makes my credit cards go away, my wallet is going in the trash. We are getting closer every day to when we only need our phones, and I can’t wait. It’s so close that the last time I went to the airport I consciously decided not to buy a wallet, because I knew it would be outdated soon.

The App & Mortar Opportunity

Shopping destinations are crowded with connected consumers. However, retail has yet to perfect a means to harness mobility to direct traffic to retail stores.

What is “App & Mortar”?

By 2010 every destination shopping center was crowded with a new way to drive traffic to their stores, but no-one has been able to do it right. Yet.

At the time, several applications sprung up that tried to address the market including Shopnear.me, Snapette, Shopkick, Fancy, and more. The runaway success of Groupon and LivingSocial (starting a little earlier in 2008) left some important lessons for new ventures in the space. Specifically, retailers were frustrated with cash-flow problems created by newbies who came once and never again, not to mention the potential for erosion of loyalty and brand value.

In 2012 and '13 big retailers are finally taking this opportunity into their own hands. According to Flurry, the “App & Mortar” segment of mobile applications grew by more than 500% in the past year. Flurry’s data indicates much of this growth was driven by the likes of Starbucks, Walmart, and Macy’s, who have all invested significant resources into their own mobile strategy.

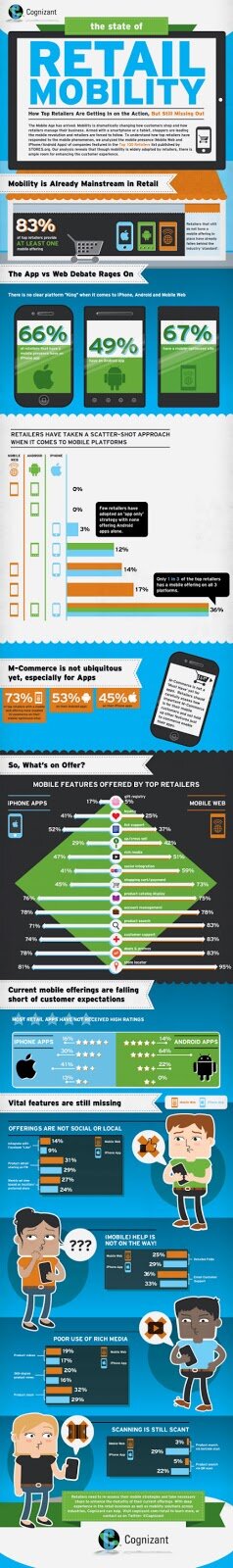

Forbes reported that more than 80% of retailers have a presence on mobile (Check out the infographic below by Cognizant). Most of them are offering all the things you’d expect, from shopping and payment to (of course) deals and store location. Retailers who can, do have a mobile presence, and some are doing a great job of executing.

What’s the big opportunity?

Shopping is often about brands, but those brands extend to the destinations. In 2010, my briefly lived startup focused on Santana Row, San Jose, precisely because the location itself is a brand. People travel there to shop, but also to spend an afternoon with family and friends. It’s a social experience as much as anything. These destination cater to a consumer who enjoys spending an afternoon in a well decorated space, where beautiful and unique things surround them, and (of course) can be acquired.

There are hundreds of high-quality individual or regional shops in any given, well-branded, retail destination. This includes a range of retailers from clothing and accessories, to health and beauty services. Are we going to rely on each retailer to have his or her own application? Do the math, that’s a lot applications and no-one wants to spend the energy to keep track of them all.

Big retailers have the advantage, since we all could use a Starbucks app or Westfield Mall app. However, that leaves a huge opportunity for the App & Mortar retail aggregators servicing the destinations and the experience. Connecting people with brick-and-mortar retail through mobile devices will change the way we shop; rather, already has. But the real promise of mobile applications for retail has yet to be fully realized.

What is “App & Mortar”?

By 2010 every destination shopping center was crowded with a new way to drive traffic to their stores, but no-one has been able to do it right. Yet.

At the time, several applications sprung up that tried to address the market including Shopnear.me, Snapette, Shopkick, Fancy, and more. The runaway success of Groupon and LivingSocial (starting a little earlier in 2008) left some important lessons for new ventures in the space. Specifically, retailers were frustrated with cash-flow problems created by newbies who came once and never again, not to mention the potential for erosion of loyalty and brand value.

In 2012 and '13 big retailers are finally taking this opportunity into their own hands. According to Flurry, the “App & Mortar” segment of mobile applications grew by more than 500% in the past year. Flurry’s data indicates much of this growth was driven by the likes of Starbucks, Walmart, and Macy’s, who have all invested significant resources into their own mobile strategy.

Forbes reported that more than 80% of retailers have a presence on mobile (Check out the infographic below by Cognizant). Most of them are offering all the things you’d expect, from shopping and payment to (of course) deals and store location. Retailers who can, do have a mobile presence, and some are doing a great job of executing.

What’s the big opportunity?

Shopping is often about brands, but those brands extend to the destinations. In 2010, my briefly lived startup focused on Santana Row, San Jose, precisely because the location itself is a brand. People travel there to shop, but also to spend an afternoon with family and friends. It’s a social experience as much as anything. These destination cater to a consumer who enjoys spending an afternoon in a well decorated space, where beautiful and unique things surround them, and (of course) can be acquired.

There are hundreds of high-quality individual or regional shops in any given, well-branded, retail destination. This includes a range of retailers from clothing and accessories, to health and beauty services. Are we going to rely on each retailer to have his or her own application? Do the math, that’s a lot applications and no-one wants to spend the energy to keep track of them all.

Big retailers have the advantage, since we all could use a Starbucks app or Westfield Mall app. However, that leaves a huge opportunity for the App & Mortar retail aggregators servicing the destinations and the experience. Connecting people with brick-and-mortar retail through mobile devices will change the way we shop; rather, already has. But the real promise of mobile applications for retail has yet to be fully realized.